ETFs

We have successfully managed index funds for clients since 1988, with dedicated portfolio management teams across global markets, leveraging our infrastructure and expertise.

HSBC Hang Seng TECH UCITS ETF

A new generation of Sustainable ETFs

View full list of ETFs.

Partnership in index and systematic equity

In late 2009, we launched our first ETFs in Europe and currently have a suite of 35 funds which are built on our strong index tracking heritage, integrated platforms and disciplined processes.

We take a pragmatic approach to managing ETFs with two equally important objectives: close tracking and minimising costs.

We offer equity market exposure to a range of global markets and carefully select indices where we can manage trading costs and liquidity.

Our tracking method and value-added approach to managing ETFs have enabled us to consistently produce returns that closely mirror the index within target tracking tolerances.

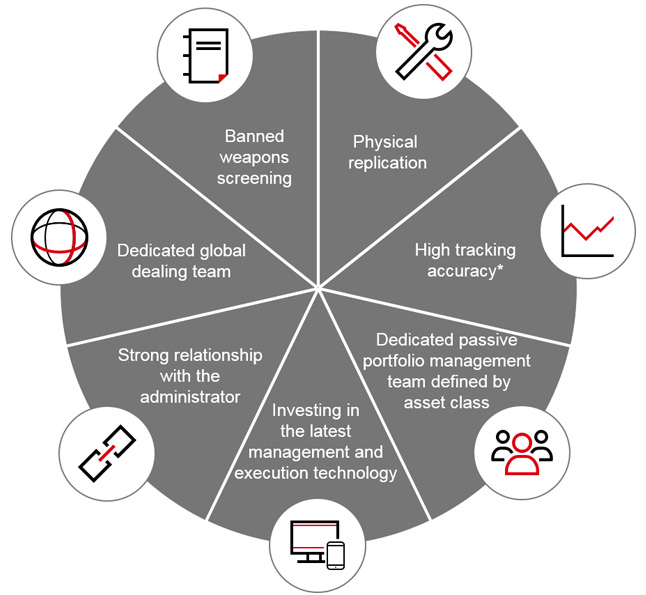

Key benefits of our ETF range

At the heart of our investment process is delivering close tracking error and managing tracking error budgets, while minimising the funds’ execution costs. We have a robust track record in providing competitively priced market access solutions.

Physical replication

Our passive equity funds benefit from our physical replication approach – where our portfolios are invested in the constituents of the underlying index, and do not use synthetic instruments, such as swaps and other derivatives, to mirror index performance.

High tracking accuracy*

Through considered implementation, we aim to find the optimal trade-off between temporary tracking error and transaction costs. The optimal balance and duration of implementation is important in achieving this objective and ultimately improves portfolio performance over time.

*Please refer to the factsheets for individual fund performance

Enhanced risk management, control and monitoring

Risk management is central to our investment process before and after investment decisions are made.

Ongoing risk management includes investment operating parameters, tracking error risk, counterparty risk, exposure risk and the accuracy of analysis of performance attributions and exposures to different parts of the underlying market.

Dedicated global dealing team

At HSBC we have traders located in key regional execution hubs. This is fundamental, as the expertise is connected to the market and exchange they operate in. This means our equity trades are handled by specialists with local knowledge, expertise and relationships, who are familiar with local service providers. At the end of the day, this can go a long way to deliver the best outcomes for investors.

Banned weapons stock screening

At HSBC we have implemented a screening of banned weapons such as cluster munitions, anti-personnel mines, chemical weapons etc. across the entire active and passive ranges – excluding investments in issuers that are involved in these weapons.

Large investment in the latest management and execution technology

Our leading proprietary technology ensures the efficiency and accuracy of information – supporting consistent tracking and fund performance. Our proprietary technology has been designed by our investment teams to meet their rigorous and robust requirements to ensure cost savings and better performance outcomes for our funds and investors

How to trade our ETFs

To invest in HSBC Global Asset Management ETFs, please contact your local stockbroker.

Authorised Participants and Market Making contact list

Bank of America Merrill Lynch

Jessica Lana / David Thompson

Email: DG.Delta_One_Trading_Europe@BAML.com

BNP Paribas Arbitrage SNC

Aurelien Cristini

Email: aurelien.cristini@bnpparibas.com

Bluefin Europe LLP

Simon McGhee

Email: europe@bluefintrading.com

Citigroup Global Markets

Andrew J. Jamieson

Email: europe.etf.trading@citi.com

DRW Global Markets Ltd/DRW Europe BV

Bernardus Roelofs

Email: gd1-trading@drw.com

Flow Traders B.V.

Christian Oetterich / Chris Meyers

Email: traders.amsterdam@nl.flowtraders.com

GHCO

Levon Piruzyan

Email: etf@ghco.co.uk

Goldman Sachs International

Rockey Agarwal

Email: Gsetfs@gs.com

HSBC Global Markets

Steve Palmer / Luke Rose

Email: etftradingdesk@hsbcib.com

Jane Street Financial

Slawomir Rzeszotko / Chris Foxon

Email: europe-etfs@janestreet.com

Morgan Stanley

Oliver Morgan

Email: europeanetf@morganstanley.com

Optiver VOF

Holger Schluenzen

Email: ETF@optiver.com

RBC Capital Markets

Matt Holden

Email: euetftrading@rbccm.com

Société Générale SA

Martina Schroettle

Email: europe.etf@sgcib.com

Susquehanna Europe

Salvatore Accurso / Marco Salaorno / Damon Walvoord

Email: etfsaleseurope@sig.com

Virtu Financial

Liam Emery

Email: euetf-trading@virtu.com

Official Market Makers:

Société Générale SA

Martina Schroettle

Email: europe.etf@sgcib.com

GHCO

Levon Piruzyan

Email: etf@ghco.co.uk

For further information, please contact HSBC directly:

HSBC ETFs Capital Market Team

E-mail: etfcapmarkets@hsbc.com

Valentina Riva

Phone: +44 (0)20 3359 5698

E-mail: valentina.riva@hsbc.com

Securities Lending Programme

From 1 March 2021, HSBC Global Asset Management will operate a securities lending programme for the benefit of ETF fund investors. Securities lending is a practice within capital markets whereby a holder of a security, such as an ETF, temporarily lends some of its securities out to a borrower in exchange for collateral and a fee. It is a well-established process within the investment management industry used to enhance fund performance through additional income earned.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. For more detailed information on how the programme affects a specific ETF, please visit the Fund Centre and refer to the Securities Lending Programme within the Documents section.

Key risks and important information

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

Key risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

- Exchange Rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations.

- Derivative risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

- Index Tracking risk: The performance of the Fund may not match the performance of the index it tracks because of fees and expenses, market opening times and regulatory constraints.

- Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

- Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse market conditions.

- Emerging Market risk: Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity.

- Focused Strategy risk: Funds with a narrow or concentrated investment strategy may experience higher risk and return volatility and lower liquidity than funds with a more diversified approach.

Important information

The HSBC ETF range are sub-funds of HSBC ETFs plc (“the Company”), an investment company with variable capital and segregated liability between sub-funds, incorporated in Ireland as a public limited company, and is authorised by the Central Bank of Ireland. The company is constituted as an umbrella fund, with segregated liability between sub-funds.

Shares purchased on the secondary market cannot usually be sold directly back to the Company. Investors must buy and sell shares on the secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current Net Asset Value per share when buying shares and may receive less than the current Net Asset Value per Share when selling them.

UK based investors in HSBC ETFs plc are advised that they may not be afforded some of the protections conveyed by the Financial Services and Markets Act (2000), (“the Act”). The Company is recognised in the United Kingdom by the Financial Conduct Authority under section 264 of the Act.

The shares in HSBC ETFs plc have not been and will not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. Affiliated companies of HSBC Global Asset Management (UK) Limited may make markets in HSBC ETFs plc.

All applications are made on the basis of the current HSBC ETFs plc Prospectus, relevant Key Investor Information Document (“KIID”), Supplementary Information Document (SID) and Fund supplement, and most recent annual and semi-annual reports, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ. UK, or from a stockbroker or financial adviser.

The indicative intra-day net asset value of the sub-fund[s] is available on at least one major market data vendor terminal such as Bloomberg, as well as on a wide range of websites that display stock market data, including www.reuters.com

Investors and potential investors should read and note the risk warnings in the prospectus, relevant KIID and Fund supplement (where available) and additionally, in the case of retail clients, the information contained in the supporting SID.

Contact us

If you would like to give us your feedback or need further information about our ETFs, please e-mail etf.sales@hsbc.com.

*To help continually improve our service and in the interest of security, we may record and/or monitor your communication with us.

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate.

y

y